Financial Modelling

Description

Corporate Deals

Providing you with transaction models that provide insight into value drivers, quantify risks and returns, and can ultimately drive a better price for you.

Strategic Plan

Providing you with models that help you to evaluate and debate strategic options.

Operational Change

Creating models that can assist with testing options, assessing synergies, and tracking benefits.

Restructuring and distress

To rebuild lender and investor confidence providing you with a credible model.

Infrastructure Finance

We provide specialist financial and modelling advice to the public sector to support contract management and efficiency reviews.

Services

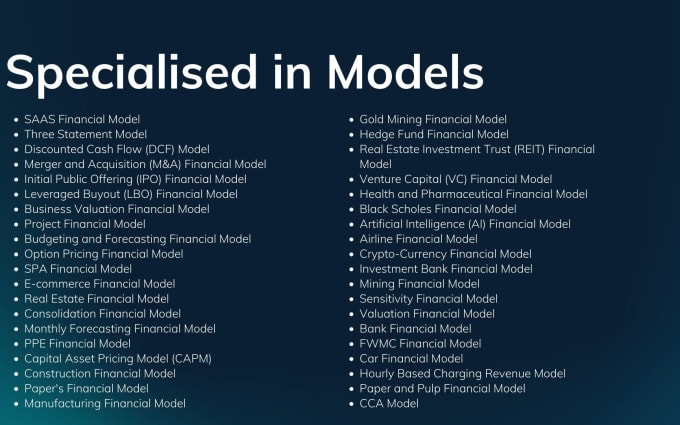

SAAS Financial ModelThree Statement ModelDiscounted Cash Flow (DCF) ModelMerger and Acquisition (M&A) Financial ModelInitial Public Offering (IPO) Financial ModelLeveraged Buyout (LBO) Financial ModelBusiness Valuation Financial ModelProject Financial ModelBudgeting and Forecasting Financial ModelOption Pricing Financial ModelSPA Financial ModelE-commerce Financial ModelReal Estate Financial ModelConsolidation Financial ModelMonthly Forecasting Financial ModelPPE Financial ModelCapital Asset Pricing Model (CAPM)Construction Financial ModelPaper’s Financial ModelManufacturing Financial ModelGold Mining Financial ModelHedge Fund Financial ModelReal Estate Investment Trust (REIT) Financial ModelVenture Capital (VC) Financial ModelHealth and Pharmaceutical Financial ModelBlack Scholes Financial ModelArtificial Intelligence (AI) Financial ModelAirline Financial ModelCrypto-Currency Financial ModelInvestment Bank Financial ModelMining Financial ModelSensitivity Financial ModelValuation Financial ModelBank Financial ModelFWMC Financial ModelCar Financial ModelHourly Based Charging Revenue ModelPaper and Pulp Financial ModelCCA ModelA financial advisor’s honest and objective feedback is worth their weight in gold.What will you get?

spreadsheet