Transaction Advisory Services

Description

Our transaction professionals have worked with a wide range of businesses which helps them in providing their clients with the advisory to manage their capital efficiently.

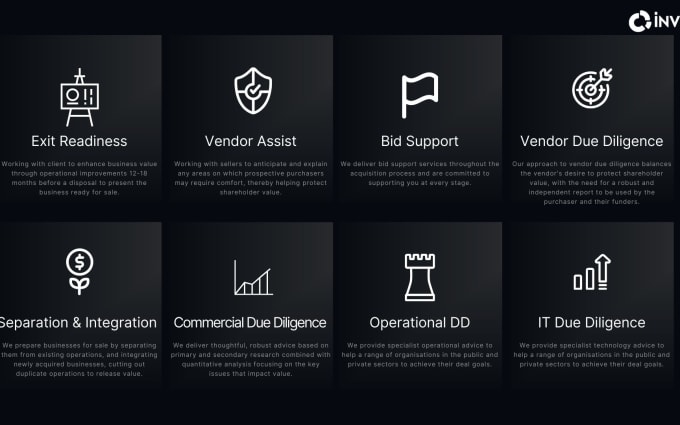

Exit Readiness

Working with client to enhance business value through operational improvements 12-18 months before a disposal to present the business ready for sale.

Vendor Assist

Working with sellers to anticipate and explain any areas on which prospective purchasers may require comfort, thereby helping protect shareholder value.

Bid Support

We deliver bid support services throughout the acquisition process and are committed to supporting you at every stage.

Vendor Due Diligence

Our approach to vendor due diligence balances the vendor’s desire to protect shareholder value, with the need for a robust and independent report to be used by the purchaser and their funders.

Separation and Integration

We prepare businesses for sale by separating them from existing operations, and integrating newly acquired businesses, cutting out duplicate operations to release value.

Financial Modelling

We build integrated models for pricing and structuring deals. We quantify returns, risks and sensitivities to provide a clear point of view to help you make better decisions.

Transaction Tax

We provide practical and pragmatic advice on tax that compliments your commercial objectives.

Financial Due Diligence

We help you make wise investment decisions, providing financial due diligence that is clearly linked to your requirements as purchasers, and is suitable for your funders.

Commercial Due Diligence

We deliver thoughtful, robust advice based on primary and secondary research combined with quantitative analysis focusing on the key issues that impact value.

Operational and IT Due Diligence

We provide specialist operational and technology advice to help a range of organisations in the public and private sectors to achieve their deal goals.

What will you get?

Spreadsheet (or in whatever form you want)