Valuation

Description

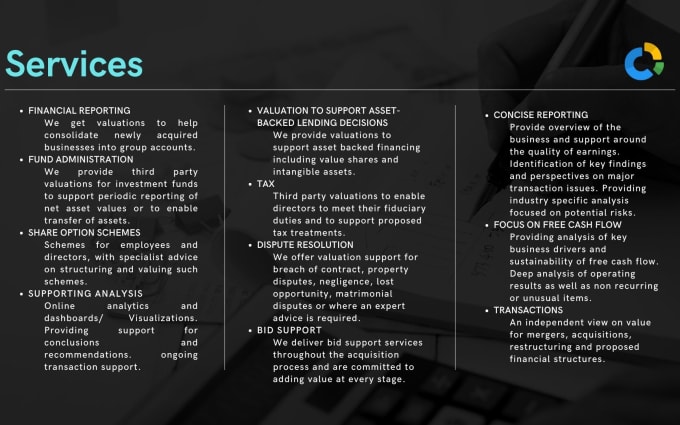

Our transaction professionals have worked with a wide range of businesses which helps them in providing their clients with the advisory to manage their capital efficiently.Financial Reporting

We get valuations to help consolidate newly acquired businesses into group accounts.

Fund AdministrationWe provide third party valuations for investment funds to support periodic reporting of net asset values or to enable transfer of assets.

Share option schemesSchemes for employees and directors, with specialist advice on structuring and valuing such schemes.

Valuation to support asset- backed lending decisionsWe provide valuations to support asset backed financing including value shares and intangible assets.

TaxThird party valuations to enable directors to meet their fiduciary duties and to support proposed tax treatments.

Dispute ResolutionWe offer valuation support for breach of contract, property disputes, negligence, lost opportunity, matrimonial disputes or where an expert advice is required.

Concise ReportingProvide overview of the business and support around the quality of earnings. Identification of key findings and perspectives on major transaction issues. Providing industry specific analysis focused on potential risks.

Focus on free cash flowProviding analysis of key business drivers and sustainability of free cash flow. Deep analysis of operating results as well as non recurring or unusual items.

Supporting AnalysisOnline analytics and dashboards/ Visualizations. Providing support for conclusions and recommendations. ongoing transaction support.

Bid SupportWe deliver bid support services throughout the acquisition process and are committed to adding value at every stage.

TransactionsAn independent view on value for mergers, acquisitions, restructuring and proposed financial structures.

What will you get?

Spreadsheet